nc sales tax on prepared food

Goods sold by artisan bakeries without eating utensils are considered non-taxable at the state level though they are subject to the 2 local sales tax just like groceries. Nc sales tax on food items.

Is Food Taxable In North Carolina Taxjar

With local taxes the total sales tax rate is.

. How can we make this page better for you. The charge received from the restaurant sounds correct. These categories may have some further qualifications before the special rate applies such as a price cap on clothing items.

1-800-870-0285 email protected Customer Service. Prepared Meals Tax in North Carolina is a 1 tax that is imposed upon meals that are prepared at restaurants. This page describes the taxability of.

You can find more examples of when prepared food is and is not taxable in Section 32 of the latest. North Carolina Department of. This tax is applicable to.

Groceries are generally defined as unprepared food. The North Carolina state legislature levies a 475 percent general sales tax on most retail sales within the state including prepared foods and beverages in restaurants. Taxation of Food and Prepared Food.

Sales Use Tax. North Carolina Will Tax Prepared Food Sold to College Students. 105-164328 and reads as follows.

The provision is found in GS. Counties and cities in North Carolina are allowed to charge an additional. Note that in some areas items like alcohol and prepared food including restaurant meals and some premade supermarket items.

Counties and cities in north carolina are allowed to charge an additional local sales tax on top of the north carolina state sales tax. Mecklenburg County Health Department 980 314-1620. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69.

Written Determinations Sales and Use Tax SUPLR 2021-0010 Sales of Prepared Food SUPLR 2021-0010 Sales of Prepared Food. ECheck Option Now Available. While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

One percent 1 of the sales derived from prepared food and beverages sold is assessed at retail for consumption on or off the premises are assessed by any retailer within the County. Do you need to submit a Prepared Food And Beverage Tax Return in Charlotte NC. A 1 tax is applicable to all prepared food and beverages sold at retail for consumption on or off the premises and applies to any retailer with sales in.

The North Carolina state sales tax. According to the North Carolina Department of Revenue a 1 tax is applicable to all prepared food and beverages. In addition to the requirements outlined by the Business Privilege License Office all food vendors must.

Food is exempt from the State portion of sales tax 475 but local sales taxes Articles 39 40 and 42 do apply to food to make up a 2 sales tax on food. Mecklenburg County hereby levies a prepared food and beverage tax of one percent 1 of the sales price of meals and prepared food and beverages sold at retail for consumption on or off. The Currituck County North Carolina sales tax is 675.

No matter if you are based in North Carolina or not based there but have sales tax nexus there charge sales tax at the rate of your buyers ship to location. With local taxes the total sales tax rate is between 6750 and 7500. The North Carolina state legislature levies a 475 percent general sales tax on most retail sales within the state including prepared foods and beverages in restaurants.

Skip to main content Menu. 28 Prepared food. PDF 69276.

Food that meets at least one of the conditions of this subdivision. The state sales tax rate in North Carolina is 4750. 800 805-9145 email protected Sales.

The tax is only imposed by local jurisdictions upon the granting of approval by the North Carolina General Assembly. Prepared Food Beverage. The Food and Beverage tax rate for Dare County is 1 of the sales price of prepared foods and beverages sold within the county for consumption on or off a.

The Wake County Board of Commissioners levied a Prepared Food and Beverage Tax of 1 of the sale price of prepared food and beverages effective January 1 1993.

Are You Required To Pay Sales Tax On Restaurant Food Purchased For Resale

Making Sense Of Sales Tax Exemption Certificates Total Food Service

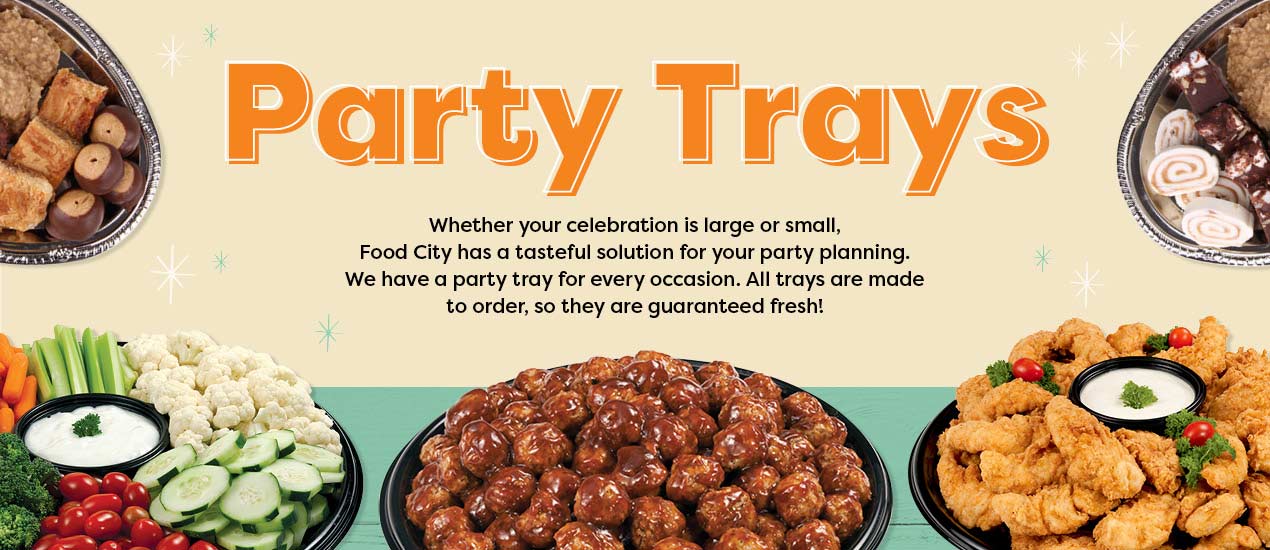

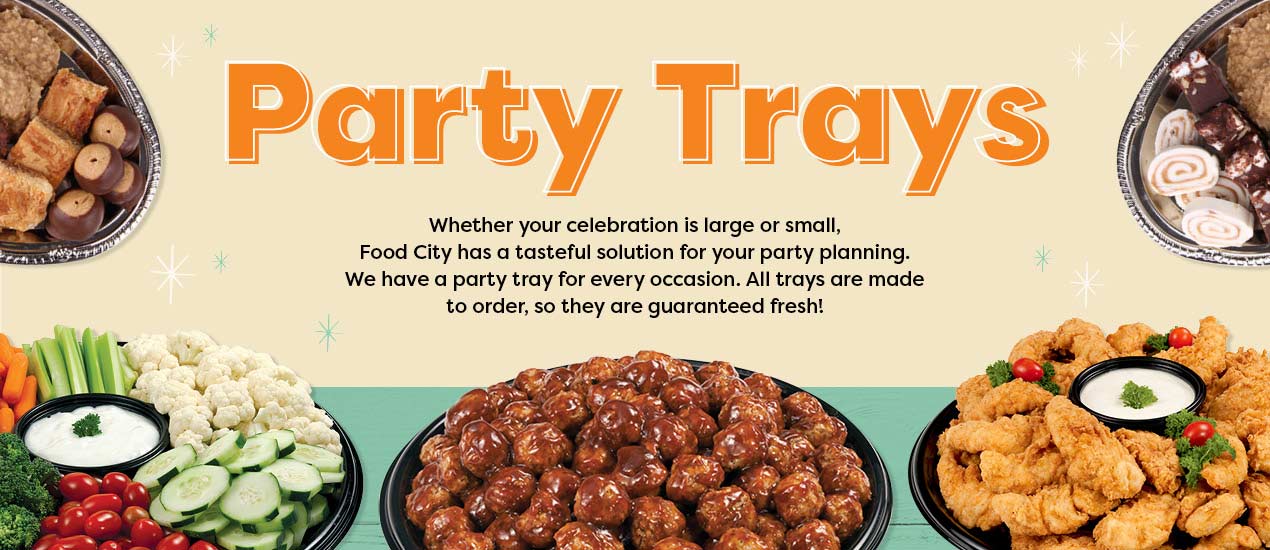

Made Fresh To Order Party Trays From Food City

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

Taxes On Food And Groceries Community Tax

Digesting The Complicated Topic Of Food Tax Article

![]()

Prepared Food Beverage Tax Wake County Government

Is Food Taxable In North Carolina Taxjar

Study Reveals Major Limitations To Fast Food Industry Self Regulation Of Advertising To Children

The Rules On Sales Taxes For Food Takeout And Delivery Cpa Practice Advisor

Tax Free Week Starts Today For Hurricane Supplies Be Prepared Now Instead Of Waiting Until A Storm Is Hea Plastic Drop Cloth Hurricane Supplies Disaster Prep

Marc Lore Invests In Wonder An On Demand Gourmet Food Truck

Tennessee Cottage Food Law Forrager

Is Food Taxable In North Carolina Taxjar

North Carolina Cottage Food Law Forrager

Vegan Food Near Me Native Foods