tax break refund date

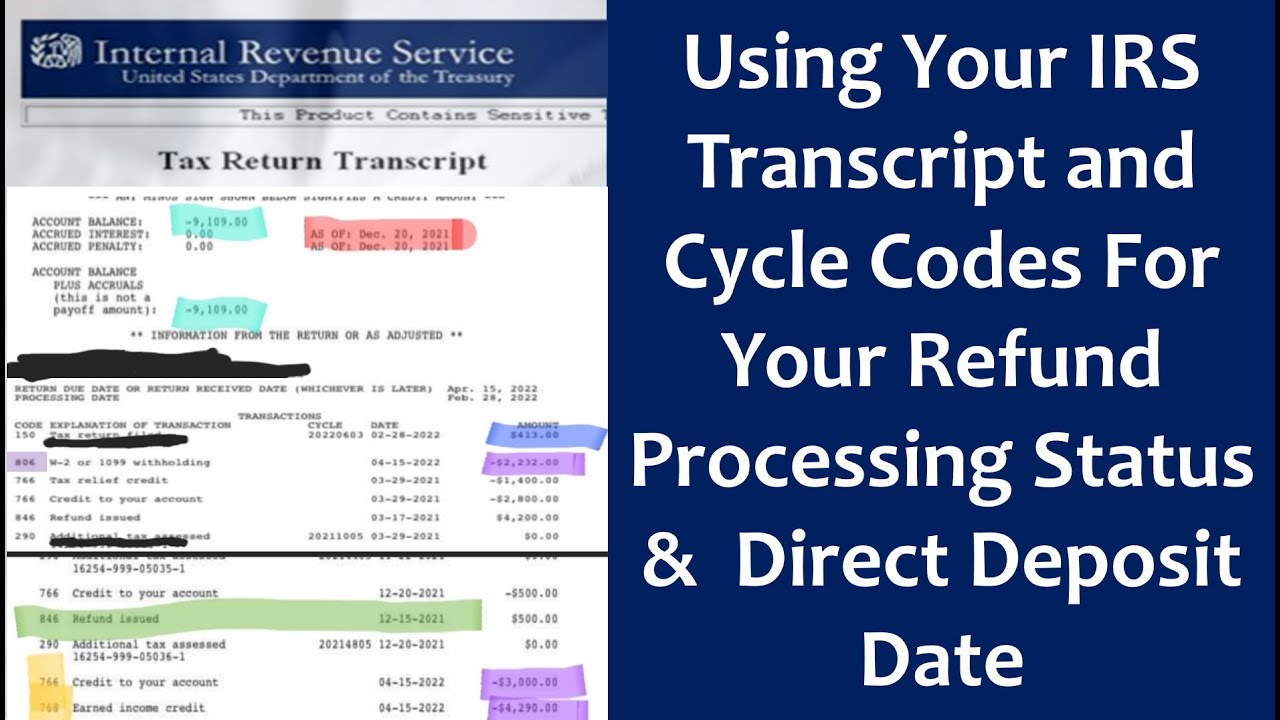

By using the chart below you can translate your IRS cycle code into a calendar date that tells you when your tax return posted to the IRS. UPDATED DECEMBER 2021 for calendar year 2022.

When Will I Receive My Tax Refund Will It Be Delayed Forbes Advisor

She would be able to receive a 1071 American opportunity credit 800 refundable and 271 nonrefundable a 3000 refundable child tax credit and a 3297 EIC.

. Current year tax returns can be e-filed and therefore take less time to process and issue your refund. For most people the biggest tax break from owning a home comes from deducting mortgage interest. This is the highest tax refund among these scenarios.

Go to IRS Cycle Codes Explained for the easiest detailed explanation to help you determine what your cycle code can tell you about your tax return and tax refund update cycle. Youll need to enter the date you filed your. When the moneys on its way.

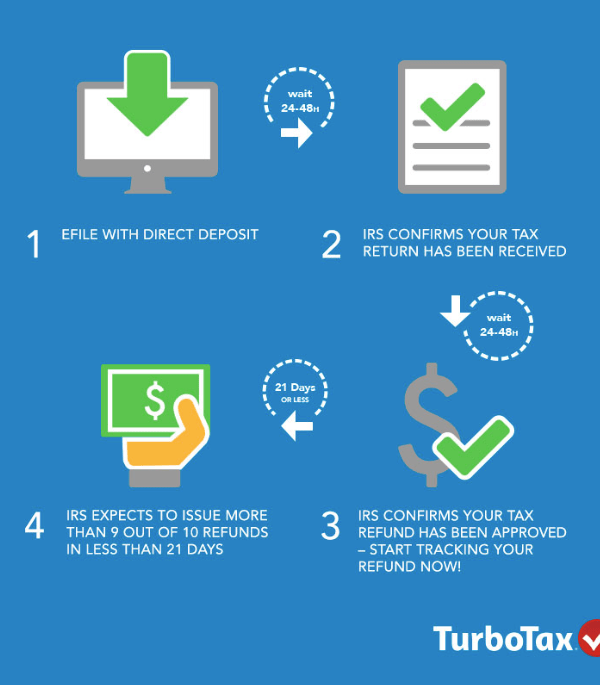

Below we break down several common reasons why your tax refund could be delayed. So the earliest date taxpayers got a refund this past year was February 26 for direct deposits and March 5 for paper checks. If you file your back tax return within three years of the return due date the IRS will generally send your refund if youre supposed to get one.

Reasons for a Tax Refund Delay. Estimate your tax refund or how much you may owe to the IRS with TaxCaster our free tax calculator that stays up to date on the latest tax laws so you can be confident in the calculations. To qualify for the refund taxpayers would have had to file an Indiana individual income tax return for 2020 with a postmark date of Jan.

It makes sense to choose whichever will yield you the greatest tax break but if you choose to itemize deductions youll need to keep track of your. If people already received the 125 refund through electronic deposit they will receive the second refund. You should receive your 2014 tax refund in 8-12 weeks.

Refund Transfer is an optional tax refund-related product provided by MetaBank NA Member FDIC. Lets break down the reality of the situation when you have unfiled back tax returns. If you have not received your refund after 12 weeks I suggest contacting your local IRS office in Amarillo.

Due to federally declared disaster in 2017 andor 2018 the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes. If you receive a refund of home mortgage interest that you deducted in an earlier year and that reduced your tax you must generally include the refund in income in the year you receive it. Refund of home mortgage interest.

The process to filing past year tax returns takes a bit longer. For more information see Recoveries in Pub. On or after May 1 2015 will be proactively refunded the APD tax.

It is not your tax refund. Deposit and is dependent on and subject to IRS submitting refund information to the bank before release date. An expected refund date.

When will I get my refund. In total she would be able to receive a tax refund of 7097. Many 401k plans allow you to log in and increase your 401k withholding which will qualify you for a bigger tax break.

You Claim Certain Credits. This is an optional tax refund-related loan from MetaBank NA. For tax years prior to 2018 you can deduct interest on up to 1 million of debt used to buy build or improve your home.

When it has approved your refund. The motor fuel tax rate for this time period is 0195 per gallon but only 0025 of that is the increased rate on which a refund may be requested. Travel agencies may refund the APD tax on eligible 001 tickets issued prior to December 5 2014 using one of the following three options.

Theres no singular reason for a tax refund delay through the IRS. The taxpayer will multiply 21325 by 0025 21325 x 0025. The taxpayer has paid 053 in increased motor fuel tax and may request a refund of that amount using Form 4923-H.

Your tax refund comes from your 2021 return and the IRS is required to start paying interest on overpayment 45 days after accepting a tax return. If you e-filed your return you can normally expect your refund about 21 days after filing. The amount of the refund will usually be shown on the mortgage interest.

Her tax liability before any credits would be 271. Loans are offered in amounts of 250 500 750 1250 or 3500. This type of workplace retirement account allows employees to defer.

If you mailed a paper return it can take six weeks or more for the IRS to issue a refund. IRS may not. Keep in mind that some circumstances can delay.

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

Tax Credits How To Get A Bigger Tax Refund In Canada For 2022

Tax Refund Deadline 2022 What Should You Know Before April 18 Marca

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Using Your Irs Transcript Tax Cycle Codes For Your Refund Processing Status Direct Deposit Date Youtube

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

Here S The No 1 Thing Americans Do With Their Tax Refund Gobankingrates

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

/GettyImages-92125643-b5c3bc0656ab41e48c59795ef5a318bd.jpg)

Tax Refund Missing Reasons You Never Received One

Tax Refunds Delayed By Irs Processing Backlog Staffing Shortages And Broken Printers The Washington Post

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

How To File Income Tax Return To Get Refund In Canada 2022

Here S How Long It Will Take To Get Your Tax Refund In 2022 Cbs News

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Will My Irs Tax Transcript Help Me Find Out When I Ll Get My Refund And What Does It Mean When Transcript Says N A Aving To Invest